Market Commentary

Market Commentary - 2023 Markets in Review: What Drove the Turnaround

Global markets staged an impressive turnaround in 2023, defying widespread recession fears from early in the year. Top financial firms like BlackRock, JPMorgan, and Forbes provide insightful retrospect on the developments behind this rally. Their perspectives inform investment strategies heading into 2024 as risks remain balanced with renewed upside opportunities.

Posted on

Read time

5 mins

Key Takeaways

Despite ubiquitous recession warnings, markets flourished in 2023:

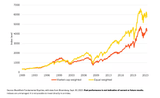

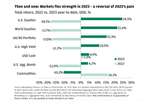

- The flagship S&P 500 index rallied over 20% year-to-date into November (BlackRock)

- Fueled by high-flying tech shares, the Nasdaq Composite scored roughly a 37% surge (Forbes)

- Even the blue-chip Dow Industrial Average topped 11% on the year (Forbes)

In the background, major market drivers took shape:

- Red-hot inflation numbers from mid-2022 moderated rapidly to only 3.2% year-over-year by October 2023 (Forbes)

- The Federal Reserve put an end to its series of jumbo rate hikes by July, sparking talk of potential cuts ahead (BlackRock, Forbes)

Despite everything, companies broadly managed to stay profitable enough to support risk asset prices.

Strategic investment narratives also evolved in 2023:

- AI adoption hit an inflection point with clear winners and losers across Information Technology

- Cryptocurrencies rebounded fiercely from 2022 lows as mainstream acceptance grew

- National security tensions stoked defense spending and commodity/energy markets globally

With cautious optimism spreading but risks respected, pundits see room for stocks to rise further in 2024, assuming corporate durability persists.

Decoding the Market Resilience

Inflation peaked back in mid-2022 before descending fairly rapidly, enabling central banks to halt runaway policy tightening that jeopardized growth. Meanwhile, corporates proved more resilient than feared, with earnings staying power against rate hikes cushioning stocks. Reflecting on these core pillars explains resilience despite persistent concerns.

Monetary Policy: The Inflation Effect

As inflation expectations become more anchored across developed markets, an end to the extraordinarily hawkish conditions that choked economic activity appears in sight. The Fed’s messaging confirms they achieved sufficient disinflationary progress to pause hikes and prepare cuts if required. Avoiding recession thus far spotlights policymakers’ improved responsiveness relative to past cycles.

Corporate Agility Provides Ballast

Underestimating businesses’ capacity to prevail against myriad current challenges left profit forecasts overly bearish in 2023. While momentum can shift quickly, firms displayed commendable pricing power, cost discipline, and operating leverage to sustain earnings growth against long odds this past year. Their continued adaptability amidst risks, old and new, grounds the case for tempered positive equity outlooks.

Market Technicals Flash Green

Behind the scenes, the equal-weighted S&P 500 now looks poised to overtake its mega-cap concentrated counterpart that led markets in recent years. This technical signal implies index gains broadening out from the narrow FAANG contingent back towards neglected sectors and smaller names – a precondition for savvy stock pickers to thrive after years of passive dominance.

Tactical Themes and Risks

Some overarching narratives stand out as informing investment allocations for 2024. These include artificial intelligence adoption differentiation, crypto’s resurgence towards mainstream utility status, escalating global defense spending from industrialized nations, and the precarious energy transition across both traditional and renewable sources.

Investor Perspectives

After a resilient 2023 saw equities defiantly recover and interest rates retreat from recent peaks, the investing backdrop appears bifurcated heading into 2024. While risks remain ever-present, from geopolitical tensions to corporate debt loads, optimism contends with caution for portfolio positioning. With careful consideration, certain investors may prudently embrace heightened exposures.

Conservative Portfolios

Conservative investors could wade partially back into equities, rotating some fixed-income exposure into quality large-cap names with stable dividends, pricing power, and insulation from uncertainty. This balances seizing selective returns with maintaining guardrails as volatility lingers.

Growth Portfolios

Those investing over lengthy timelines may embrace innovation leaders across healthcare and technology. Continuing to steadily build futures-focused holdings allows participating in sustainable upside over time despite short-term noise. Patience and an even keel smooth the long-term ride.

Opportunistic Portfolios

Opportunistic investors can employ dry powder amidst market disconnects between fundamentals and pricing. Increasing exposure to distressed areas poised to recover allows for benefiting from mean reversion. Protecting against downside risk while realizing compressed opportunities offers asymmetry.

Bottom Line

Enough positive signals are flashing to embrace cautious optimism on equities while respecting ever-present risks. Assessing the balance of evidence on how markets confounded fears makes for better-informed decisions by investors as we turn the page into 2024.

Sources: