Blog

The Fed Made a Big Interest Rate Announcement In June 2022.

For fifteen months, at every opportunity possible, the Fed has raised interest rates. That ended at 2:00 P.M. Eastern time on Wednesday 14 June, when it announced that it would keep rates steady for the first time since February 2022.

Posted on

Read time

5 mins

What Does it Mean for Investors?

In a press release, it alluded to many of the positive economic developments that enabled the decision, like positive job growth, a resilient banking system, and a generally expanding economy. In response to all the good news, the market did this:

(Source – Yahoo! Finance)

Why did investors flinch at what, on the face of it, seemed like a good thing? And what does it all mean for the market going forward?

What Happened to Interest Rates?

In October of 2008, when the U.S. stock market had shed 33% of its value and was only still on its way down, Warren Buffet cited a maxim from hockey that’s become popular among investors. “Skate to where the puck is going,” the great Wayne Gretzky used to say, “not to where it is.”

Stock prices never reflect the present state of an underlying asset, only the expected state of the asset down the line – in a few months, or even a few years for most investors (or longer, for a disciplinarian like Buffett).

Investors will act on any data that suggests something meaningful about future stock prices, like a quarterly report or a bad news story. And no single piece of news – short of major, world-historical events like COVID-19 – is ever as significant for markets as Federal Reserve policy changes. Ungodly sums of money are burned every year trying to anticipate, evaluate, and respond to acts from the Fed, which brings us to the important bit:

Investors don’t merely react to changes in interest rates. They react to the discrepancy between the changes they expected, and the changes that actually occurred.

What’s more: investors are only partly concerned with how any given change in rates will affect businesses. They’re also looking for what rate changes signal about the Fed’s thinking, as it pertains to the policies they may enact down the line.

In this light, what happened on Wednesday 14 June starts to take new shape.

Where on its own it may be construed as bullish, in context, the new leveling off of interest rates appears more like a holding pattern. Rather than a precursor for a reversal, the Fed explained in its press release, “holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.”

If the Fed is only biding time for now, in which direction might it decide to go after their next meeting? An indication can be found in its new Summary of Economic Projections.

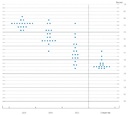

Each dot in the following chart represents one member of the Federal Open Market Committee (FOMC) – the body in the Federal Reserve System responsible for monetary policy. The location of each dot indicates that member’s judgment of an appropriate target level for the federal funds rate in 2023, and years to come.

Two aspects of the data jump out immediately.

(Source – Federal Reserve Summary of Economic Projections)

First and most obviously, all FOMC members expect rates to come down in years to come.

However, the overwhelming majority believe that rates still have room to rise in 2023. (The target range at present is 5-5 ¼, where just two of those dots sit, and none fall below that mark.)

In summary: while interest rates have leveled off for the first time in a long time, future expectations include a mix of ups and downs. This may explain why, shortly after the dip, the market quickly recovered to end Wednesday about even with where it was before the news broke.

(Source – Yahoo! Finance)

Should investors be optimistic that, after a brief rise, rates may well fall significantly?

What We Misunderstand About Interest Rates

Few people enjoy interest rate hikes – they make everything more expensive. By dissuading borrowing, the thinking goes, fewer people are willing to spend money and the economy slows down.

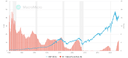

Except historical data complicates this picture. Consider the following chart, tracking the federal funds rate and the S&P 500 index:

(Source – MacroMicro)

It almost looks like a complete inverse – higher rates, lower valuations.

But it’s not fair to judge the market this way, over such a period of time. So let’s zoom in only to the most recent ten year period:

(Source – MacroMicro)

There appears to be no discernible correlation in the data, at least from 2020 onward. Before 2020, if anything, the fastest growth occurred when rates were highest. One reason for this may have to do with the most basic principle everyone learns on the first day of Economics 101.

High interest rates make borrowing expensive, thereby causing demand to fall.

Conversely, however, high rates make lending attractive. Banks are incentivized to make more loans, providing an upward pressure for growth.

Individuals feel the effects of high rates immediately – on their mortgages, their credit cards, and so on – which may contribute to negative sentiments around rate hikes. By contrast, loans only facilitate productive business growth in time periods measured in years.

We’ve seen this bear out before.

Following a conference call on December 5th, 1980, the Federal Reserve under the chairman Paul Volcker decided to raise rates a full 2%, up to nearly 20%, its highest mark in history.

The impact was felt immediately, and severely. The already flailing economy fell into recession, and already high unemployment rose higher. Car dealers mailed keys and homebuilders two-by-fours to the Fed chair, to protest his role in collapsing their markets.

But in two years’ time, inflation fell from 12.5% to 3.6%. The year after, the growth rate in gross national product rose from -1.75% to 4.51%. It remained around that mark for the remainder of the decade, as the U.S. created nearly 20 million new jobs, in an era that’s now remembered as one of the most prosperous in any country, ever.

So interest rates may go up or down tomorrow, next month, or next year. But investors need not worry about it as much as they think.