“Free-Banking” and The Birth of the Federal Reserve

The spirit of decentralized finance existed long before the creation of Blockchain investments and Bitcoin.

Many Americans in the early nineteenth century were highly opposed to the idea of a central bank. A mistrust of centralized authority was on-brand for the recently emancipated United States, and the first two attempts at establishing a central bank failed.

For a while the US was central bank free, ushering the “Free Banking” era. During this time, there was minimal financial regulation which resulted in a riotous and colorful 80-year streak of bank implosions.

Then, in 1907, a collapse in the New York City financial system triggered national panic as people raced to pull cash from regional institutions. This culminated in a now legendary meeting called by JP Morgan in his library, gathering other wealthy financiers such as John D. Rockefeller, to inject their personal wealth into the market and halt the free fall.

The Panic of 1907 was the final catalyst that led to the creation of the Federal Reserve in 1913: originally established to ensure a healthy currency and act as a lender of last resort.

Monetary versus Fiscal Policy

In 1977, Congress set new economic goals for the Fed to pursue through monetary policy — these goals came to be known as “The Dual Mandate”.

Monetary policy refers to the Federal Reserve’s actions to control the total amount of money and credit (the “money supply”) in the economy to achieve maximum employment and price stability, and to moderate long-term interest rates.

Fiscal policy is under the purview of the Executive and Legislative branches of government. These two entities determine government taxation and spending activity to shape the US economy.

How the Federal Reserve Works

The Federal Reserve has three key bodies; together, they influence the path of monetary policy in the United States.

By the way, the idea that the Fed in charge of “printing money” is a misnomer.

The Fed does not physically print money, that’s a job for the U.S. Treasury. However, while the Fed is not in charge of creating money, they are in charge of handing it out through monetary policy.

Well, “handing out money” is a bit glib.

Amusing as it would be if Jerome Powell was standing around throwing cash at people, the actual process of putting dollars into the economy (and taking them out) is more complicated.

Note there are many tools the Fed has at their disposal, but if you understand the following you’ll have a good grasp of how they function.

The Federal Funds Rate

The Fed’s primary monetary policy tool is setting the target range for the federal funds rate. Federal funds are deposits that financial institutions make at their regional Federal Reserve Bank. The federal funds rate is the interest rate at which these financial institutions trade federal funds amongst themselves. In this marketplace, the buyer of federal funds is a borrower who is seeking short-term cash, and the seller of federal funds is a lender.

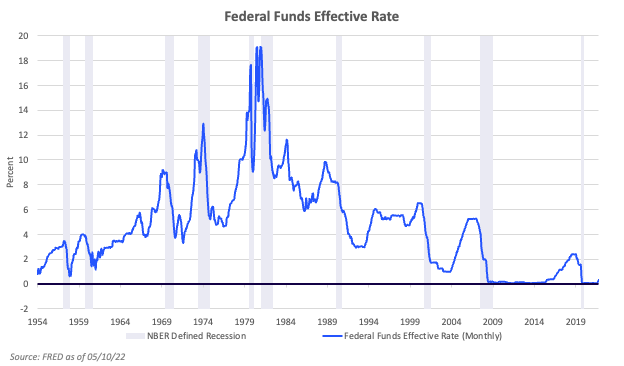

When the economy is in a recession, the Fed lowers the target range, making it cheaper to borrow and invest, thus boosting economic growth. When the economy is growing too fast, the Fed raises the target range, making it more expensive to borrow and discouraging spending, thus slowing economic growth.

Open Market Operations and Quantitative Easing

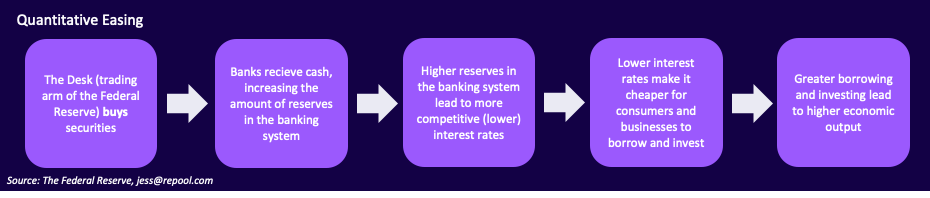

The Federal Reserve can also control the flow of money through Open Market Operations. The trading arm of the Fed (“the Desk”) transacts with approved depository institutions.

Quantitative easing (“QE”) was a massive asset purchasing program the Fed designed in response to the 2008 Financial Crisis. QE is similar in spirit to regular open market operations, but at a much, much larger scale. By looking at how QE and quantitative tightening (“QT”) work, we gain an understanding of Open Market Operations.

Quantitative Easing

When the Desk buys securities in the open market, they inject money into the banking system, increase the money supply, and apply downward pressure on interest rates and prices — thus, stimulating economic growth.

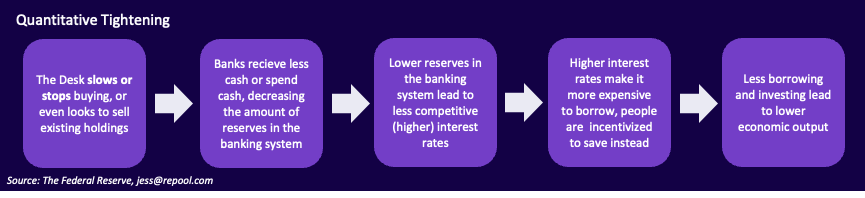

Quantitative Tightening

When the Desk sells or stops buying, they take money out of the banking system, decrease the money supply, and apply upward pressure on rates and prices — thus, throttling economic growth.

All this sounds nifty, but what are the real world consequences from the Fed’s actions? Are they even good at their job?

The good, the bad, and the ugly.

Our central bank plays an integral role in managing a complex and delicate financial ecosystem. However, we have seen costly policy errors of late.

The Fed Saves the Corporate Bond Market

On March 23rd 2020, at the peak of the COVID-19 pandemic, the Fed revealed plans for the Secondary Market Corporate Credit Facility (SMCCF). For the first time ever, the Fed was going to start buying corporate bonds.

The world’s biggest central bank said that they were willing to prop up the corporate credit market. Look at the price action below, within days the market retraced half of the sell-off.

Yet the Fed didn’t start buying until May 10th 2020. On the announcement alone, the market recovered enough to give corporate issuers the stability they needed to raise capital and weather the storm.

In a virtuous cycle, the Fed announcing that they were going to save the corporate bond market, saved the corporate bond market. They did need to follow through, but the shift in market sentiment alone was potent. The Fed is viewed as a highly credible entity, thus they can be very effective when implementing monetary policy.

Who cares if the Fed bailed out the markets (again), aren’t they just making corporations richer and ignoring average Americans?

The Fed cannot put dollars into your pocket the way other branches of government can through tax breaks and welfare. However, the Fed can make sure the economy has enough liquidity (ie. spendable cash) so that businesses are able to pay their workers and stay open. If companies were unable to raise money we would have seen more bankruptcies, more layoffs, and an even greater disruption in the provision of goods and services.

However, the Fed failed to heed major red flags about inflation that have been there since 2021.

The Fed has been accused of overextending loose monetary policy, letting the economy run hot, pumping up asset valuations, and laying the groundwork for high inflation.

You can see below how under the Fed regime, periods of economic downturn (contractions) are much shorter while times of prosperity (expansions) are significantly longer.

How much of that economic prosperity is real? How much of it was brought on by hiking rates way too late?

In 4Q21, over 71% of S&P 500 companies cited “inflation” on their earnings calls. This was a record high in the last decade, beating the most recent record high from 3Q21…yes, from three months prior. It was obvious that companies were feeling the heat from supply chain disruption, raw material scarcity, and labor shortages.

Something had to give, but nothing did.

The Fed continued to refer to inflation as transitory and didn’t do anything — which is like closing your eyes and hoping the problem will go away. Meanwhile, the stock market continued to make new highs and everything appeared okay on the surface.

Now, we’ve seen the data. Yesterday’s inflation report (CPI-U) showed an increase of 8.3% from last April to now. Other inflation reports are similarly ugly. While challenges from the Russia-Ukraine War and the shutdowns in China have added pressure, they are only exacerbating the issues we knew existed over a year ago.

Check out our last article The Yield Curve to understand why the interest rate market is viewed as an important recessionary indicator.

Citations

U.S. Bureau of Labor Statistics. (2022, May 11).

The Federal Reserve Bank of Philadelphia: The Free-Banking Era