CryptoPrimer

What is Decentralized Finance?

Decentralized finance attempts to solve many issues that centralized finance grapples with. The majority of DeFi innovations try to do so using blockchain technology and P2P networks.

Jess

Strategy at Repool, ex-Goldman Sachs Trader, Wharton MBA

Posted on

Read time

4 minutes

What is Decentralized Finance?

Like most things in life, our current financial system is a double-edged sword.

Before we get rolling, check out our Blockchain investments piece for a quick and easy primer on the technology behind DeFi.

Okay, back to my very original sword analogy.

To decentralize, or not to decentralize?

Decentralized finance attempts to solve many issues that centralized finance grapples with. The majority of DeFi innovations try to do so using blockchain technology and P2P networks.

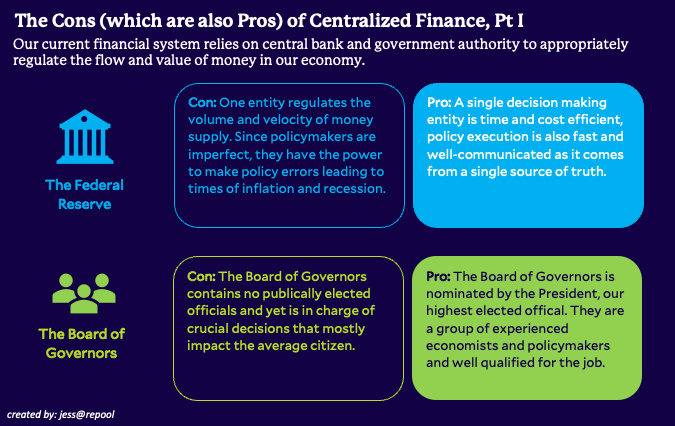

However, many of the flaws in our current system are not purely flaws. Let’s weigh some of the shortcomings of CeFi against their DeFi solutions.

Starting with our central bank the Federal Reserve, while it’s easy to point fingers with the horrendous inflation backdrop, they have also been responsible for long periods of structural stability.

Conversely, DeFi advocates for a system where “the power is in the hands of the people” or really, “the power is in the nodes of a P2P network”.

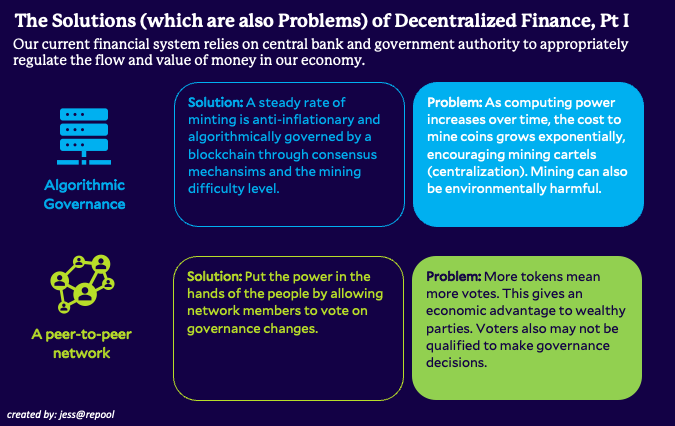

DeFi opts for algorithmic governance in lieu of policymakers and centralized control.

Governance changes are usually determined by the greatest number of node votes or voting tokens. Either way, mining pools and wealthy participants can amass considerable voting capacity, creating a centralization of power.

Furthermore, anti-inflationary measures can dramatically increase the cost of introducing new coinage over time. This makes it less feasible for individuals to mine new blocks, and reduces the diversity of players protecting the blockchain.

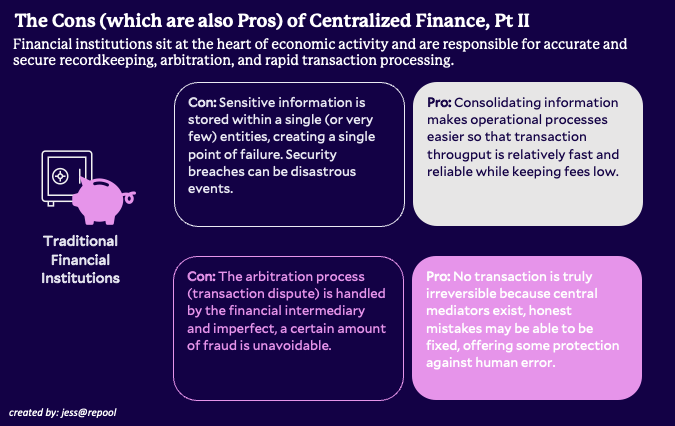

The Fed controls public money supply, but financial institutions rule the private sector.

Banks and credit card companies are the central ledgers for consumer private and financial data. These points of heavily consolidated private information are prime targets for identity theft and ransomware.

However, with consolidation comes scalability and efficiency.

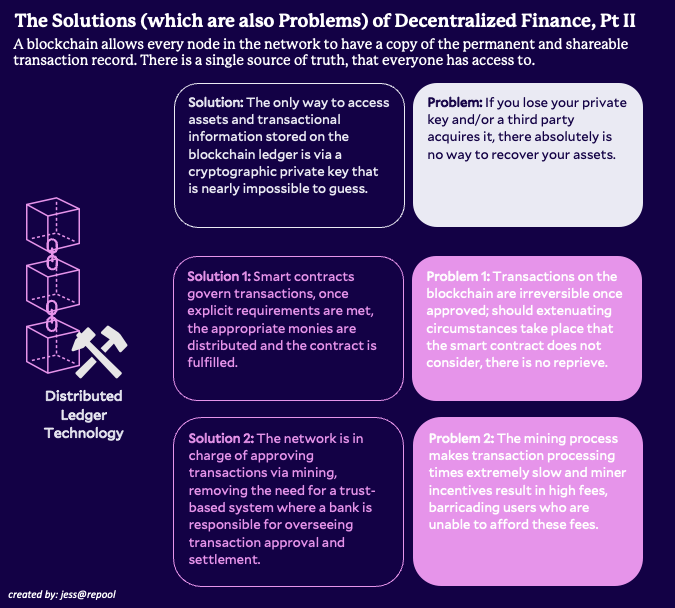

Bitcoin in particular struggles in both scalability and efficiency with an average processing speed of 7 transactions per second. Compare this to Visa clocking in an average 5K+ transactions per second1 in 2021.

Additionally, transactions completed on the blockchain are permanent. On one hand, irreversibility saves time and money on arbitration and dispute meditation.

On the other, honest mistakes such as fat-fingers and erroneous transfers have no recourse.

In short, blockchain technology, is still just a tool.

DeFi is going through many of the growing pains that traditional finance faced decades ago.

Although the technology is exciting and innovative: a lack of regulation, oversight, standardization, and transparency continues to hold this space back.

While we are still a ways away from achieving mass adoption and true commercial viability, cryptos and the inspirations fueling them are very much worth understanding.

***