CryptoPrimer

Cryptocurrency: A Complete Guide

Cryptocurrency or “crypto” is a digital medium of exchange that is used by computer networks to transfer assets without relying on a central authority (e.g. a bank) to process, record, and store transaction data.

Jess

Strategy at Repool, ex-Goldman Sachs Trader, Wharton MBA

Posted on

Read time

8 minutes

Everything you need to know about Crypto

Here we are at last, the workhorse of decentralized finance — cryptocurrency.

Since Friday’s inflation print, the global cryptocurrency market is down 22%; a pretty severe underperformance relative to benchmark equity indices.

Though it may look otherwise, this asset class is unlikely to completely go away. Today we’re going to investigate what it is cryptocurrencies claim to do, and why people have invested so much money into it.

Maybe by the end of this, you can decide whether to buy the dip or….run for the hills.

If you want more background first, check out our Blockchain investments piece, promise it’s short and sweet.

Otherwise, let’s hit it.

What is cryptocurrency?

Cryptocurrency or “crypto” is a digital medium of exchange that is used by computer networks to transfer assets without relying on a central authority (e.g. a bank) to process, record, and store transaction data.

Cryptocurrency by the Numbers

There are nearly 20,000 unique cryptocurrencies with a total market cap of $960 billion. This is a tiny asset class. Saudi Aramco’s and Apple’s market caps alone are $2.3 trillion and $2.1 trillion a pop.

The dollar distribution in this space is also heavily concentrated in a handful of tickers. The 10 biggest cryptocurrencies make up 85% of the entire asset class’ market cap.

We’re going to focus on these 10 assets as they comprise the vast majority of the market.

An Overview of the Top 10 Cryptocurrencies

At a very high level, here are the *crypto* Big 10 grouped by function.

Here’s a quick summary before we dig in.

As you’ll notice, all of these tokens are flat year-over-year, but all of the coins are way down.

So let’s start here, with the difference between tokens and coins.

What is a token?

Tokens look a lot like coins. They are exchange tradable and can have volatile prices. You can speculate on a token’s value, just like you can with a coin.

The tokens in the previous table are a special kind, known as stablecoins. We’ll dig deeper into stablecoins in a bit. First, here’s a look at all the token flavors.

Tokens are built on top of an existing blockchain and allow holders to perform certain actions. They can have multiple use cases (e.g. UNI is both a governance token and a utility token).

Tokens can also grant holders access to dapps, or decentralized applications. Dapps are a combination of a user interface and a smart contract.

Smart contracts are programs designed to execute an action once certain requirements are met.

A dapp looks just like any website or mobile app, but in the background the software is communicating with a decentralized P2P network instead of a centralized server.

In order to issue a token, creators pay the underlying blockchain using their native digital asset, a coin.

What is a coin?

A coin powers the network it was issued on, it is built into the blockchain. Think of coins as fuel for the cars (programs and miners) driving from place to place (using the chain).

For now, coins are mainly used for two different functions.

Smart Contracts and Decentralized Applications

Ethereum (ETH), BNB, Cardano (ADA), and Solana (SOL) all power the creation of tokens, smart contracts, and dapps on their respective blockchains.

These four coins alone make up roughly 19 percent of the crypto market.

Transaction Fees and Mining

Coins are also used to pay transaction fees and reward miners.

In addition to smart contract creation, BNB is used to pay for trading transaction fees on the Binance cryptocurrency exchange.

Last time, we discussed Proof-of-Work as the consensus mechanism for Bitcoin and Ethereum. In this model, BTC and ETH are rewarded to miners for finding the nonce.

The Cardano (ADA) and Solana (SOL) blockchains use Proof-of-Stake instead.

What is Proof-of-Stake?

Proof-of-Stake is a consensus mechanism that many new blockchains are adopting as a more sustainable alternative to Proof-of-Work.

The more coins you stake, the more likely you are to be selected as a validator. This incentivizes people to own more coins, thus driving up valuations.

Staking is an activity where holders agree to lock up their coins for a short period of time in order to earn mining rewards, typically paid out in the same coin.

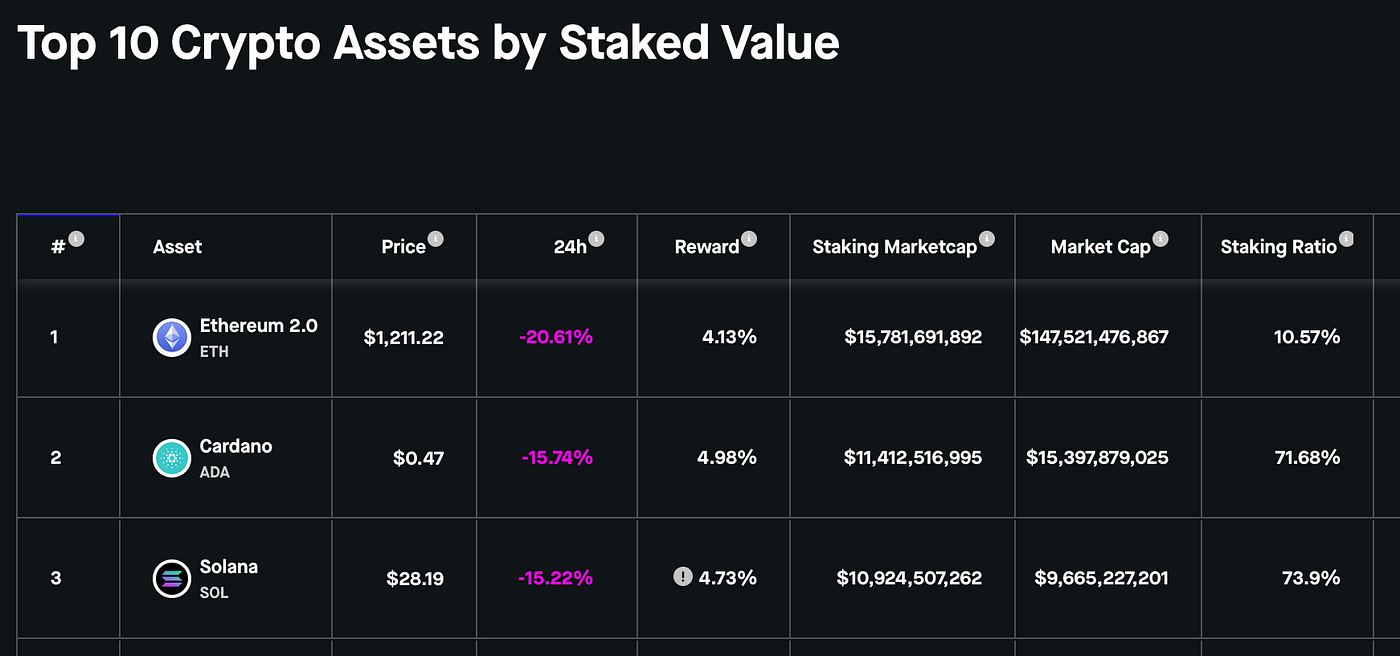

Cardano (ADA) and Solana (SOL) coins are mainly used for staking activities. In fact, a whopping 72% and 74% of ADA and SOL’s market caps are staked.

Do digital currencies have any real world applications?

In their ultimate form, coins should be digital analogs to paper money, or fiat.

BTC and ETH are the two largest digital currencies. They aim to replicate the functionality of fiat with the security of blockchain.

However, there are major differences between digital and fiat currency.

Here’s an interesting question.

If cryptocurrencies are anti-inflationary, then why are they underperforming on high inflation data?

Crypto is still an extremely high-risk investment that is largely unregulated and poorly understood. Even though it’s meant to be anti-inflationary, when the economy is in a bad spot, semantics don’t matter — bad risk does.

If the cryptocurrency asset class is largely viewed as underdeveloped with an extremely long and ill-defined time horizon to success, then who cares about “anti-inflationary”?

Small asset classes also tend to experience outsized gains and losses, it’s just so much easier for investors to move the needle.

Unfortunately, the price volatility in crypto has been a major barrier to commercial viability. Without stable prices, it’s impossible and impractical for crypto to succeed.

Luckily, mitigating price volatility is exactly what stablecoins are trying to do.

What is a stablecoin?

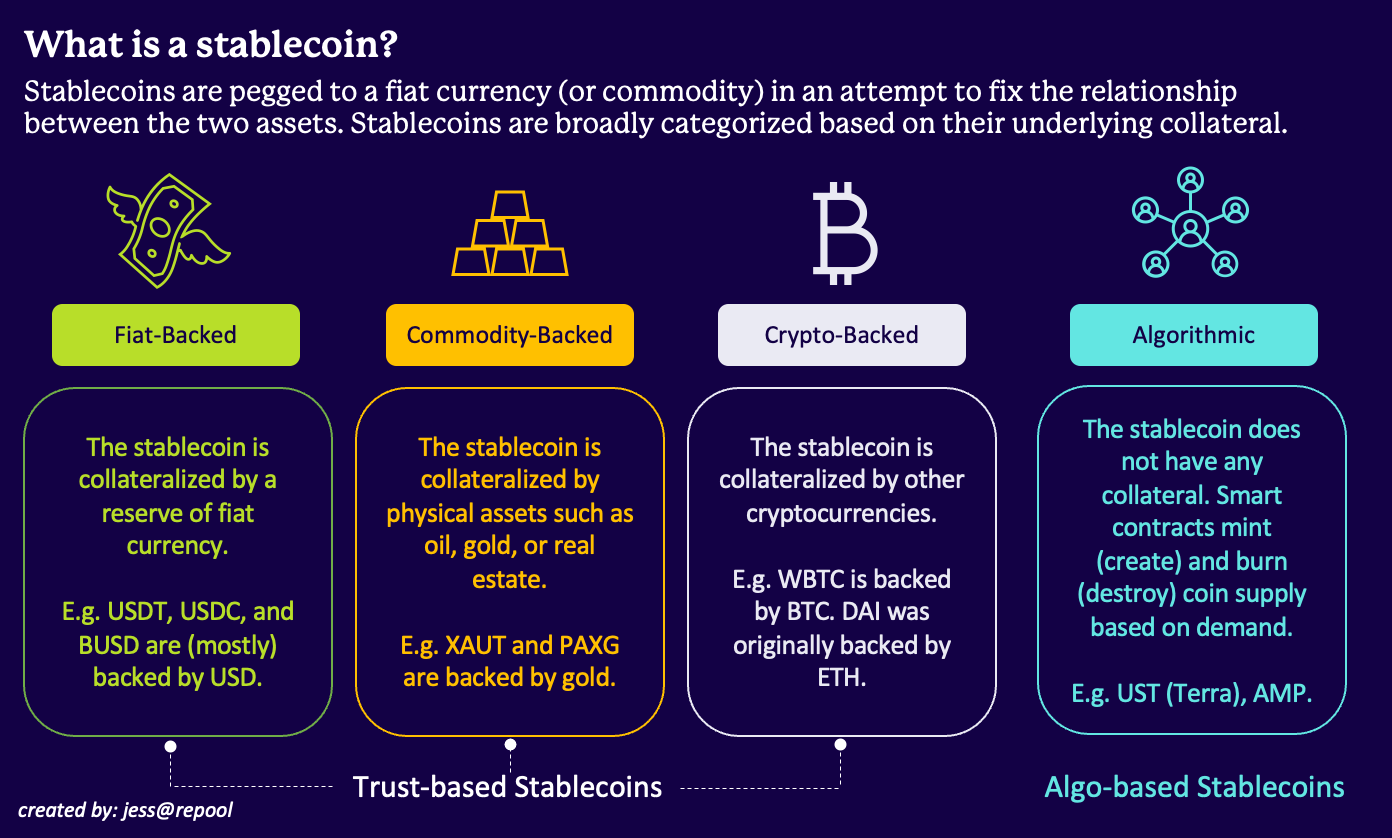

Stablecoins are an attempt to create a non-volatile digital currency. The value of a stablecoin is pegged to a fiat currency or commodity.

Stablecoins are broadly categorized by their collateral.

In the top 10, Tether (USDT), Solana (USDC), and Binance USD (BUSD) are all fiat-backed stablecoins — the most successful type by far.

Let’s look at Tether (USDT), the reigning stablecoin by market cap.

How does a fiat-backed stablecoin work?

According to Tether’s last report, the company owned $82.4B in assets against $82.2B of tokens in circulation. Therefore, every 1 unit of USDT should be backed by 1 USD (1 USDT = 1 USD).

Any USDT holder can also redeem 1 USDT for $1 through Tether’s platform.

While Tether manages total USDT supply, the 1:1 peg is held in by arbitrage.

How does stablecoin arbitrage work?

Through arbitrage, people exploit market dislocations until the relationship of USDT/USD is back to parity.

Arbitrage is the simultaneous buying and selling of the same security, or highly correlated securities, in different markets at different prices.

This is how other trust-based stablecoins work as well, just with different collateral.

Why haven’t stablecoins gained broader acceptance?

Lack of oversight, regulation, and transparency, and outright fraud have given investors significant pause in the adoption of stablecoins.

In 2021, the NY Attorney General’s office fined and banned Tether and Bitfinex from operating in New York. The two companies covered up nearly $1B in losses, misled investors about Tether’s reserves, and operated with unlicensed and unregulated third parties.

Then came the great de-pegging of Terra. This algorithmic stablecoin failure wiped out nearly $40B of investor capital.

Today, algo coins are a tiny part of the market — but they are very interesting. Stick around, we’ll cover them next time in The Rise and Fall of Terra.

Okay, there’s one more top 10 coin that doesn’t neatly fall into any of the classifications we’ve covered so far.

What is a digital bridge currency?

A bridge currency is an intermediary settlement currency that allows banks to avoid the pain of converting transactions back and forth multiple times.

In our top 10, XRP is a digital bridge currency used on Ripple’s blockchain, called RippleNet. Here’s how XRP is meant to work.

Just a few issues…

1) the price of XRP is absurdly volatile (-68% y/y) 2) XRP has yet to achieve broad acceptance in a way that makes it a suitable form of settlement and 3) the “resource savings” only factor in if a critical number of financial intermediaries adopt RippleNet.

Yes, inflation is bad — but at least the US Dollar hasn’t lost over 2/3rds of its value in a year.

Yeah we’re going to pass on this one for now.

So what are cryptos actually used for right now?

In short, speculative investments.

Buying cryptocurrencies right now is largely hoping that one day they will fulfill their mission statements and be useful in the real world.

Crypto technology and DeFi as a whole is simply not there yet, in product development, gaining consumer trust, and regulatory clearance.

This is why understanding the story behind the crypto, before you invest, is critical.

Do your homework, don’t buy the hype, and keep on reading the Deep End.