In theory, algorithmic stablecoins are a Decentralized Finance dream come true. Unlike trust based stablecoins, algorithmic stablecoins use little to no collateral.

*Sounds sweet* But wait, how would that work?

Today we’re going to cover two major types of algo stablecoins: rebase (e.g. AMP) and seigniorage (e.g. Terra).

Let’s start with an easy one.

What is a rebase stablecoin?

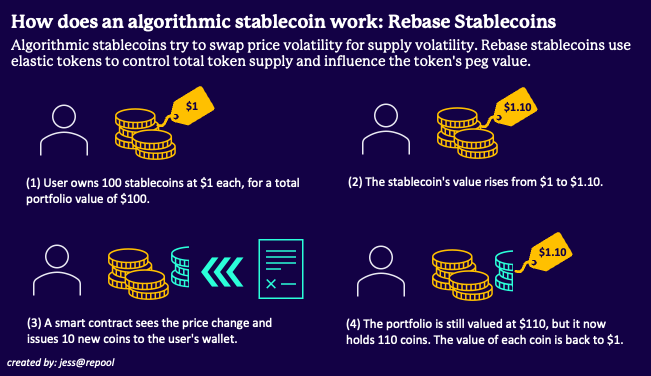

A rebase stablecoin uses an elastic token as its stablecoin.

Elastic tokens have built-in smart contracts that grow and shrink total token supply to support the peg value.

When elastic tokens mint/burn supply, holders receive/lose a pro-rata number of tokens, keeping their overall percentage of ownership and portfolio value constant.

Let’s check out AMP, the largest rebase stablecoin by market cap.

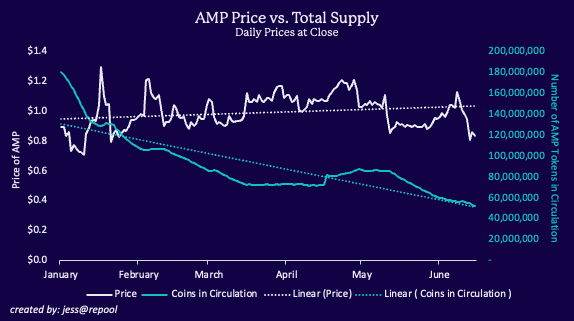

As AMP’s price goes above its peg, more AMP is issued. As AMP’s price goes below its peg, AMP is burned.

So if AMP has been stuck around $0.80, then why isn’t supply dropping more?

AMP is pegged to the 2019 dollar +/- five percent. We may have had just a touch of inflation since then, so the peg is really between $0.83 to $0.92.

If AMP’s closing price is in this range, there is no rebase that night.

Easy enough, right? The main focus here is how elastic tokens work, as they play a key role in regulating Terra — a seigniorage stablecoin.

What is a Seigniorage Stablecoin?

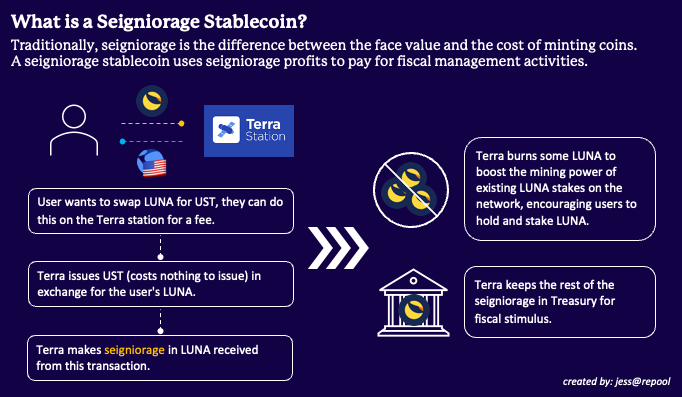

Seigniorage stablecoins use profits from minting new coins to pay for programs aimed at growing stablecoin adoption and supporting the peg.

You’ll notice what people commonly refer to as “Terra” is actually two tokens — Terra and Luna.

Note: These tokens have been rebranded as TerraClassic (LUNC) and TerraUSDClassic (USTC), not to be confused with the new Terra project that is being launched under the ticker LUNA.

Why does Terra have two tokens?

Unlike AMP, Terra’s system has two assets: a stablecoin and LUNA, an elastic token. Terra’s USD stablecoin was originally called UST.

LUNA was a regular cryptocurrency that Terra’s smart contracts used to create and destroy UST.

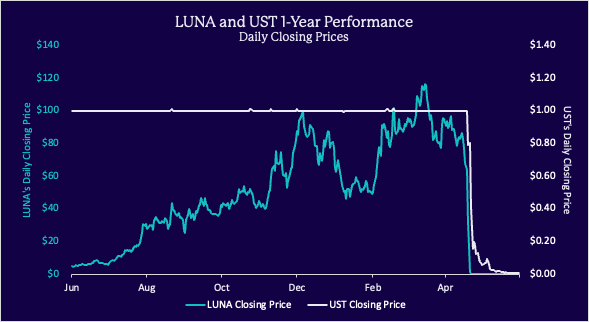

As such, LUNA’s price was free-floating, reaching a high of $119 before the crash.

What drove LUNA’s valuation?

Terra uses Proof-of-Stake, whereby miners stake LUNA to earn rewards. Larger stakes translate into a higher likelihood of being chosen as validator and receiving rewards.

Terra’s platform also gave miners a boost by burning about half of the LUNA received in seigniorage, which increased LUNA’s scarcity.

These processes incentivized investors to hold LUNA and drove valuations.

How did LUNA and UST work together?

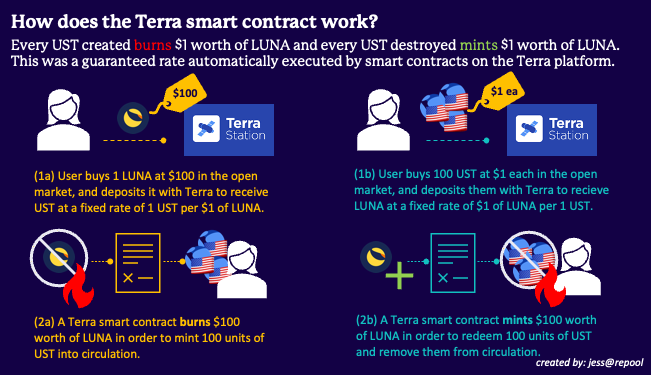

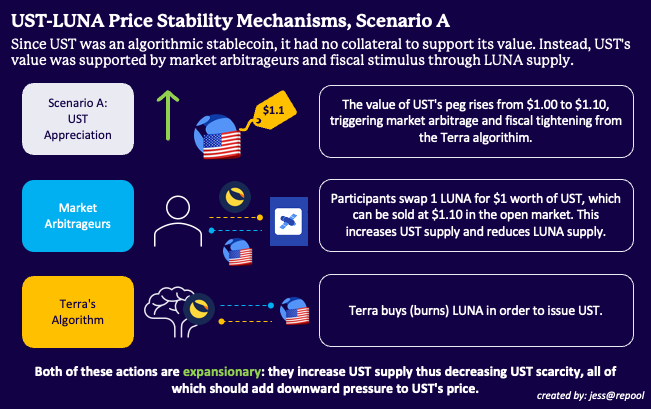

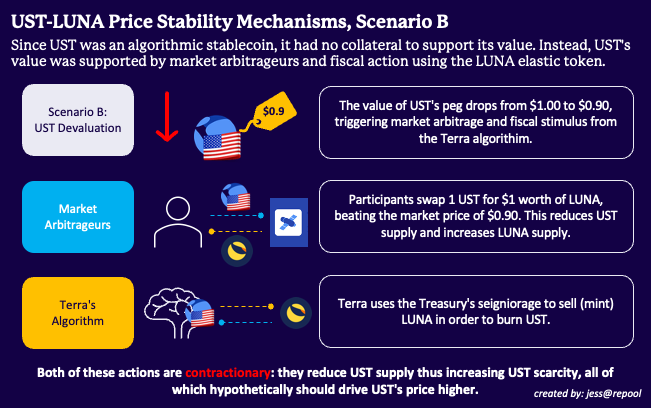

Terra acted like a central government by using LUNA to adjust fiscal policy and control UST’s peg.

In the graphic below, think of LUNA as tax revenue/government spending, and UST’s peg as a measure of growth in the Terra economy.

To stimulate growth (boost UST’s price), Terra spent LUNA and burned UST. To combat inflation (lower UST’s price), Terra burned LUNA and spent UST.

Furthermore, anyone could redeem 1 LUNA for $1 worth of UST, or 1 UST for $1 worth of LUNA — this encouraged market arbitrageurs to support the peg.

Of course, the arbitrage worked both ways, to support and weaken the peg.

Now we know why people bought LUNA and how LUNA was used to support UST prices. But there’s still a big elephant in the room.

What drove UST’s valuation?

If there was no collateral backing UST, how did Terra get people to believe UST is worth anything but zero in the first place?

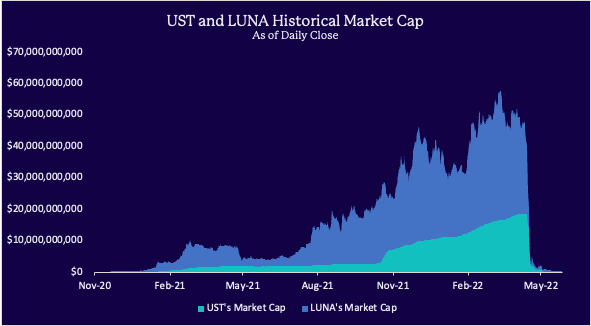

At one point, the UST/LUNA ecosystem was valued at nearly $60B — a far cry from zero.

What’s a surefire way to get people to buy something? Pay them a lot of money to do it.

Meet the Anchor Protocol. The Anchor Protocol is a lending platform on the Terra blockchain that allows users to stake their UST and earn up to 20% APY.

Prior to the crash, 76% of the total UST in circulation was deposited on the Anchor Protocol.

Clearly, this was a huge incentive to buy and hold UST.

How did Terra fail?

There’s a huge vulnerability in this system.

Since UST’s peg is purely supported by LUNA supply, technically LUNA is UST’s collateral.

If LUNA’s volatility is too high, investors begin to lose confidence in the system and sell their LUNA, increasing LUNA supply. Panic selling causes more investors to bail, hyper-inflating LUNA supply, which devalues UST’s collateral and ends in a permanent de-peg.

This is called a death spiral.

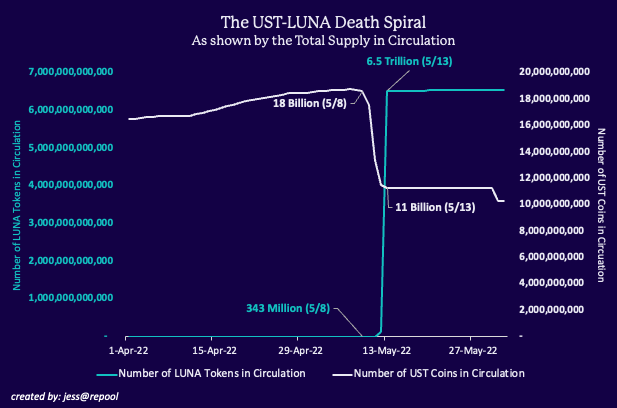

As Terra scrambled to reinstate UST’s peg, it minted more and more LUNA.

In the end, LUNA supply spiked 1,911,427 percent. Hyperinflation drove LUNA’s price to rock bottom, resulting in an irreversible death spiral.

The Beginning of the End

On May 8th, records showed $2.3B out of $14B in UST deposits were pulled from the Anchor Protocol. By the end of the week, $12.2B was gone.

As massive withdrawals and liquidations in UST commenced, UST’s price dropped. Sensing this, Terra printed more LUNA to buy back UST and try to save the peg.

In the end, UST lost its peg on May 9th, and has been de-pegged ever since.

Conclusion

On June 8th, the NY Department of Financial Services released new regulation specifically targeting stablecoins.

The stablecoin must be fully backed by a Reserve of assets, meaning that the market value of the Reserve is at least equal to the nominal value of all outstanding units of the stablecoin as of the end of each business day.[6]

In effect, algorithmic stablecoins are now outlawed in New York, a decidedly bearish indicator.

While regulation still has a long ways to go, implosions like this should be a major wake up call to investors of all sophistication levels.

As always, do your homework, don’t buy the hype, and keep on reading the Deep End.